- MTS Growth Hub

- Posts

- 💸 Reprogram Your Mindset For Financial Freedom!

💸 Reprogram Your Mindset For Financial Freedom!

Saturday 12th April

🧠 The Money Mindset That’s Holding You Back

Most of us were never taught how to manage money - we were just told to “save it” or “don’t waste it.” But your relationship with money starts in your mind. If you grew up around fear, guilt, or lack of finances, chances are you’re operating from a scarcity mindset.

That sounds like:

“There’s never enough.”

“I’ll never be rich.”

“Money is stressful.”

“I’m just not good with money.”

These beliefs keep you stuck. They make you afraid to invest, take risks, or even believe you deserve financial success.

💡 What Is a Scarcity Mindset vs. Abundance Mindset?

A scarcity mindset revolves around the belief that resources - whether money, opportunities, or success - are limited, leading to fear, competition, and a sense of lack. On the other hand, an abundance mindset recognises that there are limitless opportunities and resources available, creating optimism, collaboration, and a growth-oriented outlook.

Embracing an abundance mindset is important because it opens the door to creativity, resilience, and long-term success, while a scarcity mindset can keep you stuck in fear and limitations. Shifting to abundance allows you to approach life with confidence and openness to possibilities.

Scarcity Mindset | Abundance Mindset |

|---|---|

“Money is hard to get.” | “Money flows when I create value.” |

“If they win, I lose.” | “There’s more than enough for everyone.” |

“I can't afford that.” | “How can I afford that (smartly)?” |

“I need to hoard what I have.” | “I trust that what I give/invest will grow.” |

⚡ Why Instant Gratification Keeps You Broke

Swipe now. Buy now. Pay later.

We’re living in the age of dopamine economics - where brands, influencers, and apps are all wired to make you spend emotionally, not intelligently.

But financial freedom doesn’t come from spending everything you earn. It comes from delaying gratification and playing the long game.

Ask yourself:

Do I buy things for the high or for real value?

Is this purchase helping future me… or just soothing stressed-out me?

What would happen if I waited 48 hours before buying that thing?

💰 How To Reprogram Your Mind For Wealth

🧠 1. Audit Your Money Beliefs

Write down everything you believe about money. Be honest.

Then ask:

“Is this belief helping me grow?”

“Where did this belief even come from?”

“What belief would future wealthy me choose instead?”

You can’t build a new reality with old programming.

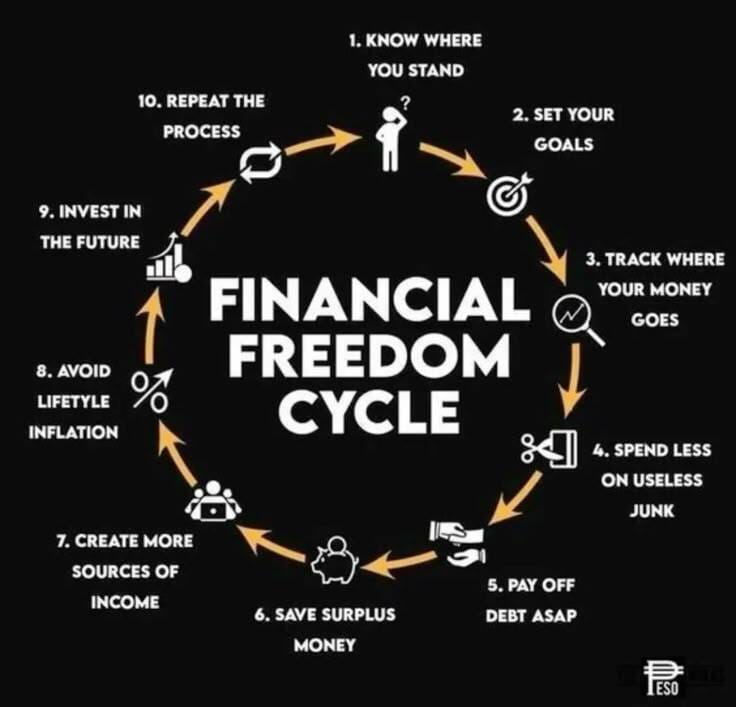

📊 2. Track Your Money Like You Respect It

What you track, grows.

Even if you're not a “numbers person,” tracking your income, expenses, and savings is a mindset shift. It moves you from being reactive to intentional.

Start small:

✅ Use apps like Notion, YNAB, or just Google Sheets

✅ Do a weekly 5-minute money check-in

✅ Celebrate small wins (like saving an extra £10)

🔒 3. Build Your “Freedom Fund”

Instead of just saving for stuff, save for freedom.

A freedom fund = money that buys you time, choice, and peace.

It doesn’t matter if it starts with £5 a week - it’s about building the habit of valuing your future over a momentary impulse.

📚 4. Upgrade What You Feed Your Mind

If you constantly consume content that encourages spending, comparison, or hustle without purpose, it’ll shape your money mindset.

Instead, fill your feed with:

Finance creators who break down money in a relatable way

Podcasts/books on wealth, not just “getting rich”

Stories from people who built success quietly and sustainably

🎯 5. Start Acting Like Future You

Want to be the kind of person who’s financially free, abundant, and confident with money?

Start acting like it now.

Would future-you impulse buy, or invest that money?

Would future-you avoid checking her bank account, or review it with clarity?

Would future-you shrink herself, or walk with quiet wealth energy?

💭 Final Thought

You can’t change your money story overnight - but you can rewrite it, one small shift at a time. Financial freedom isn’t about deprivation. It’s about intentionality, self-respect, and long-term vision.

💡 Try this today: List three things you're grateful for in your financial life right now, no matter how small.

"An abundance mindset turns obstacles into opportunities, challenges into growth, and limits into endless possibilities."

— MTS Growth Hub